Fees for outgoing wires are on the higher end.

#Wire transfer fee free

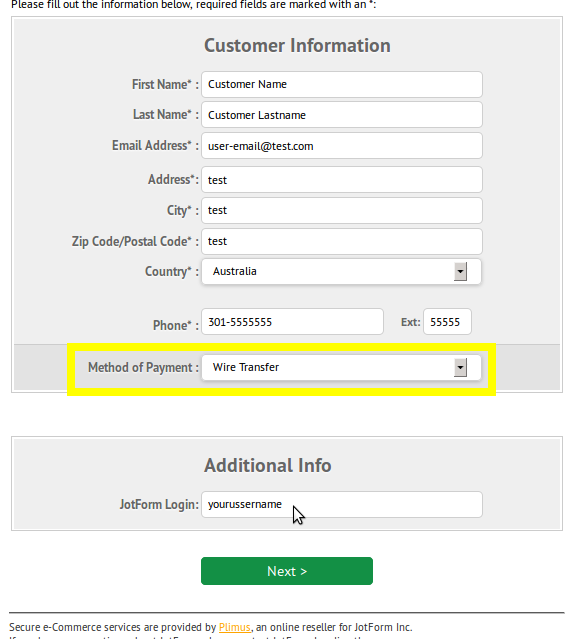

Similar to Discover, outgoing domestic wire transfers are $30. Capital One 360 – Another online bank with generally low fees, they offer fee-free incoming wire transfers.Fidelity – While traditionally known for its investment arm, Fidelity offers a cash management account with zero wire fees.Discover doesn’t charge for incoming wires, though its outgoing wire fee is $30. Discover – While you may be more familiar with Discover for credit cards, they also offer money market and online savings accounts.Since Ally has low fees all around, this is a good option if you plan to receive a lot of wires. Ally – This online bank has no fees for incoming wire transfers and a mid-range fee for outgoing domestic wire transfers.

The locations are on the east coast and offer free incoming wires and reimbursement for one outgoing wire per statement cycle (either domestic or international), making it a top option if you initiate wires frequently. TD Bank – This is the best bank for outgoing wire transfers.Some of the lowest fees for incoming wire transfers (both domestic and international) include: Many of the banks listed in the table below offer free accounts that make it easy to open an account with them even if you continue your relationship with your current bank. If you have ongoing wire transfer fees, think about switching banks to take advantage of one with no or low fees. The lowest fees were often with online banks and financial institutions better known for investing rather than a typical checking account. There are a handful of banks that offer free incoming wire transfers, both domestic and international. And if that doesn’t work, pick a bank with no or low fees (more on that in the next section).Ĭhoose Banks With Low or No Wire Transfer Fees If you need to transfer money within the U.S., there are often ways to do that with your bank that don’t require a wire transfer. Avoid Wire Transfer Feesįirst, determine if you really need to wire the money. If you’re really unlucky, the sending bank or a bank in the middle (an intermediary bank) will take out a chunk, too, meaning you could see upwards of $50 to $100 taken out of your money before it ever lands in your account.

Similarly, if someone in another country wires you $1,000, but you only see $970 in your bank account, it’s because your bank has taken out $30. For example, if you want to wire $20,000 for a down payment on a house, you might pay an additional $35 for the wire transfer fee.

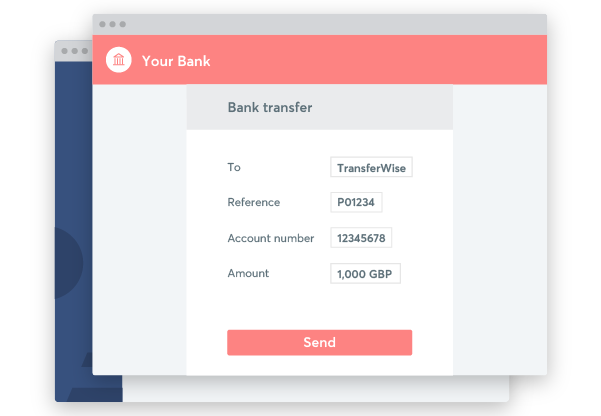

This means that if you want to wire someone money, you’ll likely need to pay a fee on top of whatever you’re sending. There are ways to reduce wire transfer fees or avoid them altogether if you know how.īanks charge wire transfer fees both on outgoing and incoming wires. Wiring money can be a secure way to move funds quickly, but it often comes with a hefty fee. This content has not been provided by, reviewed, approved or endorsed by any advertiser, unless otherwise noted below. We may receive compensation from the providers of some products mentioned in this article.

0 kommentar(er)

0 kommentar(er)